Is India shifting to a Premium Market???

In January

this year, Goldman Sachs reported that the “Affluent” Indians with Annual Income

of $10000 or more has grown 12% faster than the Population of others in last 4

years and is set to become 10Cr by 2027.

This Growth

will fuel a demand of what I would call mass-Premium Products among the

Customers

Let us analyze few Industries: The most talked about is the Two-Wheeler industry. Over the last 4 years, the Premium Bikes Market share has gone up from 14% to 20 %. Individually all the companies have started having Premium Bikes in their Portfolio – including Hero Motors which has relaunched Karishma and plans to launch 2 more Harley Based XX440 this year. The company is planning another investment of about 1000 crores in this segment. I am specifically talking about Hero Motors since the company is the late entrant to Premium game and was complete dependent on the Mass Market.

Moving to a

more personal – Perfume Industry, it should be noted that the industry is

expected to grow to $1.32 Bn at a CAGR of 15% between 2022-27.

The players in the industry have been streamlining their distribution Channels like Department Stores, supermarkets and hyper markets, the portfolios being increased and shop-in shops have started cropping up. Innovation is propelling the appeal of deodorants, with the introduction of deo-sticks, pocket-sized variants and no-gas body sprays. As the industry navigates these aromatic crosswinds, its ability to adapt and innovate will undoubtedly define its fragrant future in India.

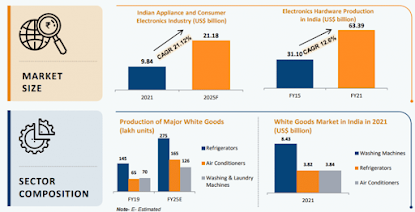

Consumer Durables:With knock down due Lockdown and Inflation wearing off by 2022, the industry start posting -spectacular results since Q1FY23 and is expected to grow at CAGR of 21 % between 2021-25 and Hardware Production to grow by 12.6%CAGR thanks to PLI schemes.

The same in all other industries FMCG, Brown Goods and even cars where the percentage of Premium product in Maruti Suzuki has grown.

This premiumization may be influenced by borrowing power Vs. earning power. This may not augur well for the economy. This growth is being fueled by Credit Growth. The usually shy Nationalized Banks have reported a Robust Credit Growth of 15.6% in FY23(a 11-year High). This growth is Powered by Personal Loan. Personal Loans (incl Housing Loans) registered a growth of 20.6% in FY 23, fueled by Housing Loans. The Trend is clear- Borrowing for Consumption as below Graph shows

Gist: The Industries have aligned themselves and are in positive framework to take advantage of this explosion. With More expenditures from the Government in Infrastructure, there will be no stopping. Is India at a pivotal point of Growth just like US of the 50’s with more percentage of People being affluent and the consumption patterns move towards Premium products?? Let’s see how things pan out.

Comments

Post a Comment