Should I Invest in an NFO? Why I Usually Don’t Fall for the Hype

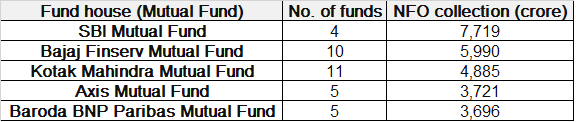

Every few months, a New Fund Offer (NFO) comes knocking — packaged with buzzwords, glossy brochures and a convincing pitch from your mutual fund app or distributor. “Limited window.” “First-mover advantage.” “Thematic opportunity.” It all sounds exciting. A total of 176 NFOs were launched in FY24 amassing an amount of ₹63,538 crore In the fiscal year 2024 with significant contributions from major players, indicates investor trust and various market approaches.(source Upstox)

Top five fund houses for FY2024:

But here’s my honest take: I rarely invest in NFOs.

And I’ll explain why — with some real 2024 NFO examples to back it up.

🚨 1. NFOs Come with Buzz — and Built-In Costs

Let’s start with something most

investors overlook: the cost of an NFO is often higher in the early years.

Why? Because mutual fund houses spend a lot during the launch phase — marketing

campaigns, distributor commissions, roadshows and promotions.

And where does that money come from?

The same pool your returns come from.

That means your investment is often

burdened with launch costs before it even gets a chance to grow. You're

not just buying into a fund; you're also paying for its ribbon-cutting

ceremony.

🧠 2. Is this fund bringing anything truly new to the

table?

Most NFOs are simply minor

variations of existing themes. Unless a new fund gives me access to a fresh

asset class or a clearly differentiated strategy, I don’t see the point.

Take the Aditya Birla Sun Life Nifty

India Defence Index Fund, launched in August 2024. It offered thematic

exposure to India’s growing defence sector — sure, it’s a niche. But today,

nearly a year later, it’s trading at around ₹12.60(11th Jun'25) from its launch NAV of ₹10.

That’s not bad — but it’s not revolutionary either - despite being pivoted up by Operation Sindoor.

Compare that with the Motilal

Oswal Business Cycle Fund, also launched in mid-2024. It gained over 29%

since launch, now trading near ₹12.43 (as on 11th Jun'25). Sounds impressive, but I still ask: Do

I believe in this strategy long-term — or is it just riding a short-term wave?

Bottom line: “New” isn’t the same

as “better.” And most NFOs aren’t breaking new ground.

🎯 3. Does it actually fulfill a need in my investment

plan?

A new fund might be trending, but

that doesn’t mean I need it. If my portfolio already includes diversified

equity, hybrid, debt and international funds — then adding another thematic or

sector-specific NFO won’t necessarily improve my outcomes. In fact, it might

overcomplicate things.

Consider the Sundaram Multi Asset

Allocation Fund, launched in January 2024. It gives exposure to equity,

debt and gold. Useful? Yes. But unique? Not really. Existing Multi Asset or balanced

advantage or hybrid funds offer similar exposure — and with years of data to

back them.

Today, its NAV is roughly ₹12.46 (as on 11th Jun'25) — decent performance, but nothing extraordinary compared to peers with track records of handling different market cycles.

So unless a fund solves a

specific problem or fills a gap in my plan, I don’t add it — no matter how

new or popular it is.

📊 4. Would I pick this over a fund with a proven track

record?

Let’s say an NFO is in a category

already packed with strong performers. Would I still pick the newcomer?

For me, the answer is usually no.

Take the Franklin India Multi Cap Fund — launched in July 2024, currently trading around ₹10.26 (as on 11th Jun'25). It's a good fund and multi-cap exposure is solid. But when I compare it to older multicap funds with 5–10 year histories, consistent returns and well-known fund managers — I’d still lean toward those. Because with them, I know how they behave in bull runs, corrections and sideways markets.

And then there’s the Axis Nifty500 Momentum 50 Index Fund, launched in early 2025. It’s barely touched ₹11.28 (as on 11th Jun'25) since inception. Momentum-based investing can do well, but it’s also one of the most volatile strategies. Without historical data to back performance, I’m just speculating.

Track record matters. A flashy strategy is no substitute for a fund that has

consistently delivered — through thick and thin.

🔍 NAV Snapshot: 2024–25 NFOs ( As of June 2025)

|

Fund |

Launch Price |

Current NAV |

Notes |

|

Franklin India Multi Cap Fund |

₹10 |

₹10.26 |

Solid start, but better peers exist |

|

Aditya Birla SL Defence Index |

₹10 |

₹12.46 |

Thematic, early volatility, no trend |

|

Motilal Oswal Business Cycle |

₹10 |

₹12.43 |

Strong start, still untested long-term |

|

Sundaram Multi Asset Allocation |

₹10 |

₹12.46 |

Balanced approach, not unique |

|

Axis Nifty500 Momentum 50 |

₹10 |

₹11.28 |

An average return, no trend yet |

✅

So, Should You Invest in an NFO?

Sometimes, yes — but only when it

checks three clear boxes:

- Genuine novelty:

Does it offer exposure to something I can’t access through other funds?

- Strategic fit:

Does it fill a specific gap in my financial plan?

- No better existing option: Is there no older fund doing this better, with proven

results?

If the answer to even one of those

is no, I usually pass. And unless it's a closed-ended fund,

there’s no urgency — I can always wait, watch performance for a year and enter

later if it proves itself.

🧠 Final Thoughts: I Choose Performance Over Promises

NFOs are designed to excite, to

create urgency, to trigger FOMO. But I’ve learned that excitement isn’t a

strategy — discipline is.

If a fund’s only edge is that it’s

new, I pass. If it’s promising but unproven, I wait. And if it competes with

well-established performers, I go with the devil I know — not the angel I

don’t.

Because in investing, it’s not about

how new the opportunity is — it’s about how well it fits your plan and how

consistently it delivers.

Disclaimer: The views expressed by the Author are his own and their appearance in the article does not imply endorsement or disapproval. Please consult your Financial advisor.

Comments

Post a Comment